In the heart of Pierce County, a remarkable story of transformation is unfolding. It begins with Noemi Cagatin-Porter, who once found herself homeless at the Tacoma Rescue Mission with three children before the age of 21. Today, she leads CJK Community Homes, a nonprofit organization that’s revolutionizing how communities approach housing stability and financial empowerment.

Through funding from the Washington State Department of Commerce’s Community Reinvestment Project (CRP), CJK is creating pathways to financial independence for historically marginalized communities.

A vision born from personal experience

“I grew up poor in the Philippines—no running water, no electricity,” recounted Cagatin-Porter. “What we have here is abundance.”

Her journey from homelessness to founding CJK Community Homes four-and-a-half years ago exemplifies the transformation she now helps others achieve. This deep understanding of both poverty and possibility drives the organization’s approach to community support.

The organization began with a seven-bedroom house that Cagatin-Porter had initially planned to renovate for her family. Instead, it became the foundation for a housing program that now serves 130 low-income individuals and families in nearly 30 transitional facilities and permanent homes across Pierce County. This expansion reflects growth in numbers and a deep understanding of what comprehensive support looks like for communities historically left behind.

Breaking new ground with the Community Reinvestment Project

When CJK Community Homes received $280,000 in Commerce funding under the CRP, it meant more than financial support.

“The CRP funding has allowed us to give more people opportunities to learn about financial savings, credit, and all the important things we need in order to be self-sufficient and succeed,” Cagatin-Porter explained.

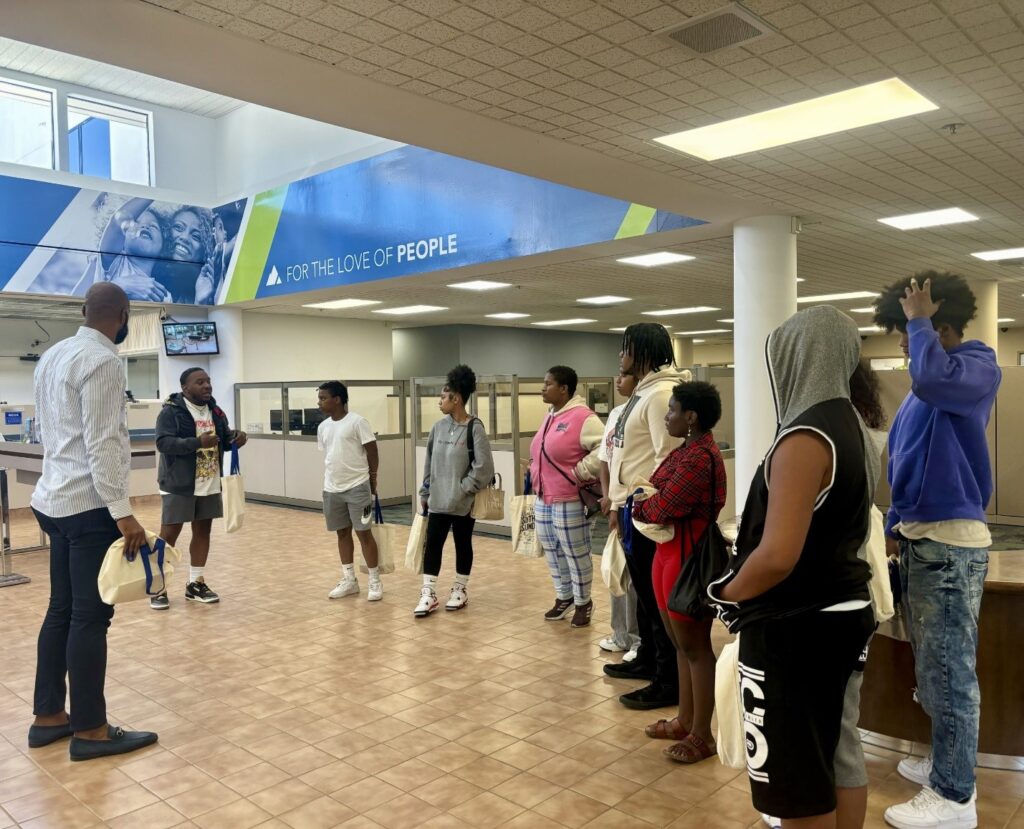

The organization takes a distinctly practical approach to financial education through its Fun in Finance program and a standout partnership with TAPCO Credit Union exemplifies its commitment to real-world learning. TAPCO’s vice president hosts youth participants at its Tacoma headquarters, and he provides his personal phone number to students, ensuring ongoing support as they navigate their financial journeys. During these visits, participants engage with everyone from tellers to the CEO, learning about building credit, home loans, and the fundamentals of banking in an accessible, welcoming environment.

Cagatin-Porter described their methods. “Let’s put together a budget. This is the minimum wage, this is the cost of living… Let’s be realistic about putting a budget together for you, and then let’s calculate your hourly wage and how likely you are to make $25 to $30 an hour to live on your own.”

Quality over quantity: A strategic approach

“We’re looking for quality, not quantity,” emphasized Cagatin-Porter. “We want to truly be intentional and give them that one-on-one attention.”

This philosophy has shaped CKJ’s approach to the CRP-funded program, which consists of four carefully designed cohorts serving different community segments.

The program’s success is evident in its outcomes. The first cohort, focusing on youth ages 12 to 17, saw 12 children and their parents opening their first bank accounts. The second cohort, targeting young adults ages 18 to 25, not only established banking relationships, but also connected clients with employment opportunities through WorkSource’s Economic Security for All program.

Recognizing the importance of role models, CJK brings in successful Black community leaders to work with young adults. Leaders such as Stephon Harris from the University of Washington Tacoma and other prominent community figures share their expertise and have transparent discussions about income and career pathways.

The program is now expanding to serve the Asian American and Pacific Islander community. It will soon launch in King County, hosted by the Renton Chamber of Commerce.

Beyond the classroom: Creating transformative experiences

CJK Community Home’s innovative approach extends beyond traditional financial education. They create immersive experiences that show participants what’s possible through financial success. This includes tours of the Port of Tacoma, where participants connect directly with human resources representatives about job opportunities, particularly in areas facing workforce shortages due to retiring employees.

The program culminates in a series of unique cultural experiences designed to broaden horizons and demonstrate the tangible benefits of financial success. Participants attended performances by Grammy-winning opera star J’Nai Bridges, enjoyed culinary experiences with nationally recognized Chef Shawn Tibbitts of Tibbitts Fern Hill, and celebrated their graduation at El Gaucho, one of the region’s premier restaurants. These experiences were documented by Grit City Magazine, giving participants lasting memories of their achievements and aspirations.

A holistic approach to financial empowerment

CJK’s approach stands out for its comprehensive nature and targeted focus on communities that have historically faced barriers to financial services.

“For them to be able to relate to people that look like you, that have experienced the same experiences as you and have come out of it — that’s a game changer,” Cagatin-Porter stated.

The organization’s impact is measurable and significant.

“Our clients, because of our rental reporting, have seen an increase in credit score of almost 150 points,” Cagatin-Porter noted. “That history alone has allowed them to be able to move past our program into their own apartments, into their own houses, or into becoming homeowners.”

Their success stories are remarkable: 44 individuals have graduated from the program, with two achieving homeownership, and nine families successfully transitioned.

A recent success story involves a 25-year-old immigrant veteran who closed on his home in November 2023. Through partnerships with organizations such as Black Home Initiative and HomeSight, CJK connects clients with down payment assistance programs, making homeownership more accessible for historically marginalized communities.

Creating lasting impact

The financial program’s impact extends far beyond individual participants.

“Our people have learned so much that they’ve gone and applied it to their families and friends as well,” said Cagatin-Porter. “Their parents are calling me like, ‘Oh, this is what they learned today.’”

This multiplier effect demonstrates how targeted investment in financial literacy can create ripples of change throughout communities.

The organization’s commitment to comprehensive support extends to all members of the community, including seniors and people with developmental disabilities. Understanding that not every client will achieve homeownership, CJK focuses on creating stability and dignity for all participants, whether through permanent supportive housing or shared living arrangements.

“I want them to see what they can experience if they set themselves up the right way,” Cagatin-Porter explained. “And the sooner for them to know this, the better, because I didn’t start until way down the line.”

Looking forward

To those still struggling, Cagatin-Porter offers a message of hope born from personal experience: “You’ll come out of it. Keep working hard, with tenacity. Persistence and hard work will get you to where you want to be.”

The success of CJK Community Homes demonstrates the powerful impact of combining lived experience with targeted support and comprehensive services. Its work through the Community Reinvestment Project shows how strategic investment in financial literacy can create lasting change for individuals and communities.

As they prepare for the third and fourth cohorts, including expansion into King County, CJK Community Homes continues to refine its approach. The organization’s success offers valuable lessons for other organizations working to create economic opportunity in historically marginalized communities:

- Center lived experience in program design and delivery

- Combine practical education with real-world opportunities

- Create comprehensive support systems that address multiple barriers

- Focus on quality and intentionality over quantity

- Build strong community partnerships that create tangible opportunities

The story of CJK Community Homes is more than a success story—it’s a blueprint for how targeted investment in communities, combined with lived experience and comprehensive support, can create lasting pathways to financial independence and stability.

As Washington state continues to address historical inequities through the CRP, CJK Community Homes stands as a powerful example of what’s possible when we invest in communities with intention and understanding.

Learn more on the CJK Community Homes website and follow the organization on Facebook and Instagram.